us japan tax treaty withholding rate

Notwithstanding these provisions the treaty provides for a zero percent withholding rate for dividends paid if the beneficial owner of the dividend is a company that has owned directly or indirectly greater than 50 percent of the voting stock of the. For the purpose of claiming tax treaty benefits PDF207KB.

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

Film royalties are taxed at 15.

. United States of America 0 1 10 0 2 0 2. Rate of withholding tax Interest. US-Japan Tax Treaty.

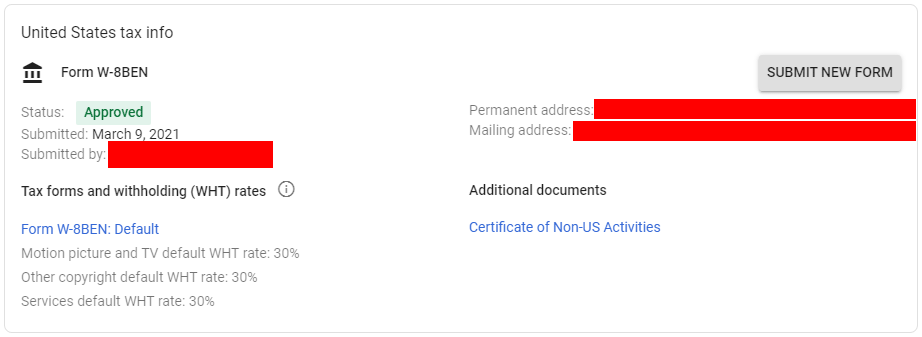

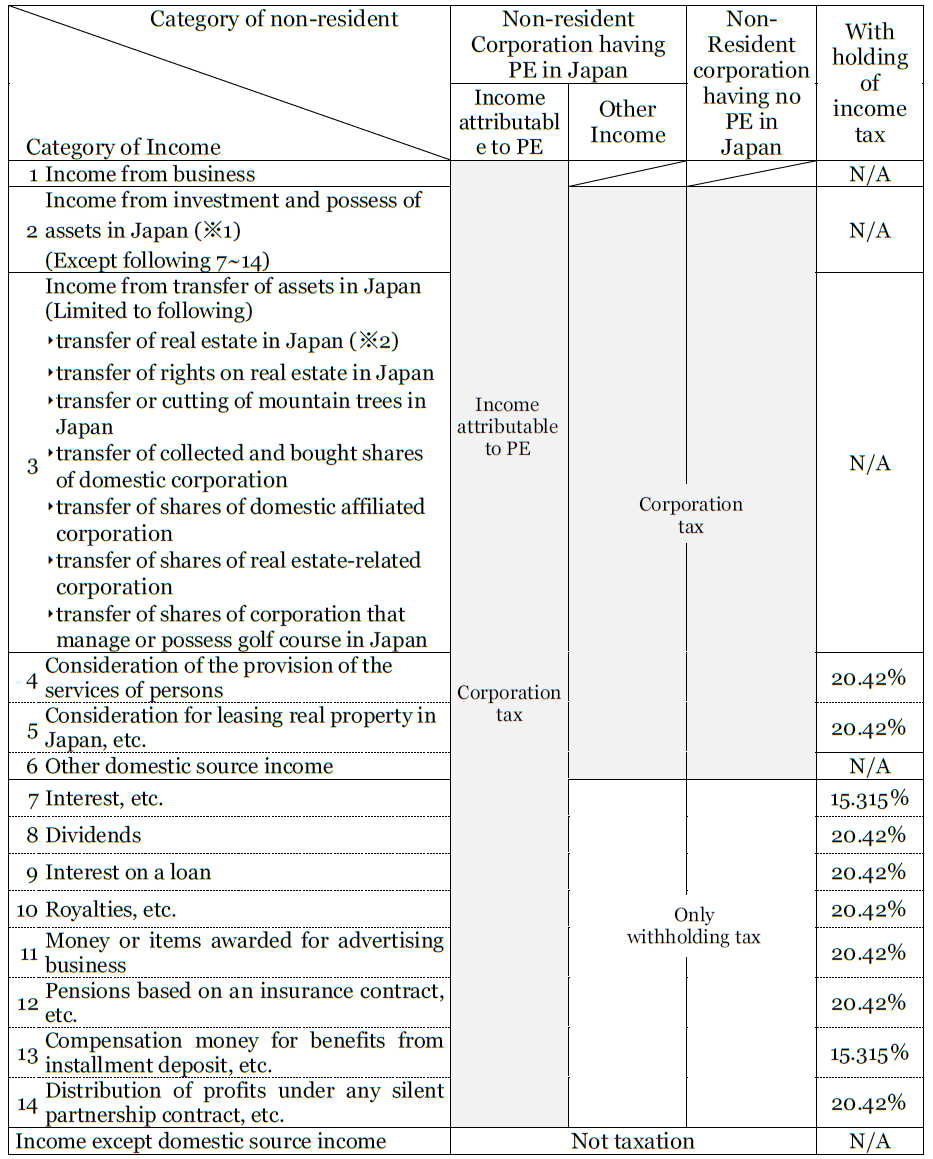

All persons withholding agents making US-source fixed determinable annual or periodical FDAP payments to foreign persons generally must report. There is a tax treaty between Japan and the country where the non-resident resides. Explanations above are based on Japanese domestic tax law.

Argentina and the United States of America Limited double tax treaty. With Regard to Non-resident Relatives. Tax Treaty Japan and the United States Sign a Protocol Amending the Existing Japan-US.

The entries for regular post office accounts will show gross income along with withholding tax 20315. 61 rows In other situations withholding agents may apply reduced rates or be exempted from the requirement to withhold tax at source either under domestic law exceptions or when there is a tax treaty between the foreign persons country of residence and the United States that provides for such reduction or exemption. This article discusses the implications of the United States- Japan Income Tax Treaty.

It helps a taxpayer decided which country to pay taxes to when the taxes are due and helps prevent dual taxation. Tax Rates for Japan. Continue reading Tax treaties.

Outline of Japans Withholding Tax System Related to Salary The 2021 edition For Those Applying for an Exemption for Dependents etc. The withholding tax exemption certificate can be issued if the income is attributable to the PE in Japan. 15 10 0 but VAT at 19 unless exempted.

In an effort to strengthen the bilateral. Income Tax Treaty PDF- 2003. For definition of large holders please refer to the article 10.

Japan 3 25 10 27 28 5. Passbooks for bank. Each prefecture is overseen by a governor.

Global tax rates 2022 is part of the suite of international tax resources provided by the Deloitte International. Corporate - Withholding taxes. The FAQs address how such treaty-related requests.

Of the treaty for double taxation between USA. Although the Protocol was signed on 25 January 2013 and approved by the Japanese Diet on 17 June 2013 it took 6 years and 7 months from the signature to the enactment due to additional time necessary for US ratification procedures. The withholding tax on dividends paid to corporate shareholders that own 10 50 of the subsidiarys voting stock is 5.

Last reviewed - 01 February 2022. Japan Inbound Tax Legal Newsletter August 2019 No. Foreign companya resident in Dividends Interestb Royaltiesb Tax sparing relief Non-treaty nil 15 10 A Treaty Albania nil 5 0c 5 NA Australia nil 10 10 NA Austria nil 5 0c 5 NA Bahrain nil 5 0c 5 NA Bangladesh nil 10 10 A Barbados nil 12 0c 8.

The United States and Japan Tax Treaty Article Six VI refers to income generated from real property and basically provides that if a Resident of one of the states generates income from the other state then that other state may be able to tax the income. The instruments of ratification for the protocol to amend the existing Japan-US tax treaty Protocol were exchanged between the two governments and entered into force on 30 August 2019. This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments.

Algeria Last reviewed 02 March 2022 Resident. Protocol Amending the Convention between the Government of the United States of America and the Government of Japan for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income PDF 2013. However the WHT rate cannot exceed 2042 including the income surtax of 21 on any royalties to be received by a non-resident taxpayer of Japan under Japanese income tax law.

An approved tax treaty between Japan and the United States is in place. The protocol to amend the Japan-US tax treaty entered into force on 30 August 2019. Local management is not required.

The list below gives general information on maximum withholding tax rates in Japan on dividends and interest under Japans tax treaties as of 12 January 2022. Japan is a member of the United Nations UN OECD and G7. Covered taxes in Japan are expanded to include the national consumption tax inheritance tax and gift tax.

Application Form for Certificate of Residence in Japan. The updates to the Japan-US tax treaty included in the 2013 protocol should provide taxpayers with potential benefits including relaxation of the requirements to qualify for the dividend withholding tax exemption and the. Technical Explanation PDF - 2003.

Japanese withholding tax rate might be reduced or exempt if. Rates Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34 including local taxes Residence A company that has its principal or main office in Japan is considered to be resident. Application Form for Income Tax Convention etc.

May 24 2021. Protocol PDF - 2003. The tax treaty with Brazil provides a 25 tax rate for certain royalties trademark.

Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev. Japan is comprised of 47 prefectures and eight regions. Although the Protocol was signed on 25 January 2013 Japan time and approved by the Japanese Diet on 17 June 2013.

Corporate Income Tax Rate. Paragraph 1 shall be lent in the collection of revenue claims that is necessary to. Under US domestic tax laws a foreign person generally is subject to 30 US tax on the gross amount of certain US-source income.

The US Japan tax treaty eliminates withholding taxes on dividends paid by a Japanese subsidiary to its US parent if the parent has owned 50 or more of the subsidiarys voting stock during the preceding 6-months. Income Tax Treaty SUMMARY On January 24 2013 Japan and the United States signed a protocol together with an exchange of notes related thereto the Protocol amending the income tax treaty signed by the two countries in 2003 as. 2013 Technical Explanation of Protocol Amending the Convention between the Government of the United States of America and the Government of Japan for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income.

Japans tax agency on 19 May 2021 released a set of frequently asked questions FAQs with information about nonresidents and other eligible persons that submit requests to seek a reduction or exemption from withholding tax pursuant to a provision of an income tax treaty. Convention Between the United States of America and Japan for the avoidance of double taxation and the prevention of fiscal evasion with respect. Withholding Tax Rates 2022 includes information on statutory domestic rates that apply to payments from a source jurisdiction to nonresident companies without a permanent establishment in that source jurisdiction.

Application of tax treaty. Japan-US Tax Treaty 2013 protocol entered into force on 30 August 2019 the date Japan and the US exchanged instruments of ratification and applies to withholding taxes on dividends and interest paid or credited on or after 1 November 2019.

Us Expat Taxes For Americans Living In Japan Bright Tax

Youtube To Introduce Tax For Youtubers Outside U S Starting From June 2021 Tehnoblog Org

2 Withholding Tax Rates On Royalties Paid To The United States Download Table

Foreign Dividend Withholding Tax Guide Intelligent Income By Simply Safe Dividends

Form 8833 Tax Treaties Understanding Your Us Tax Return

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Japan United States International Income Tax Treaty Explained

Doing Business In The United States Federal Tax Issues Pwc

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

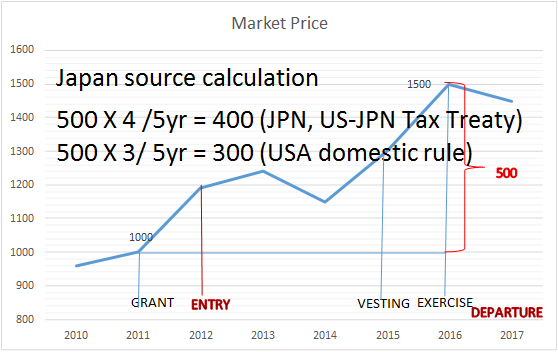

Income Tax On Stock Award For Expatriate Ata Tax Accountant Office

Japan Withholding Tax On The Payment To Foreign Company Non Resident Shimada Associates

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

Status Of Russia S Initiative On Amending Its International Tax Treaties To Increase Withholding Tax Rate On Dividends And Interest To 15 Percent Deloitto China

Japan United States International Income Tax Treaty Explained

Trump Tax Plan Halts Inversions But Increases Treaty Shopping Vox Cepr Policy Portal

Portfolio Interest Exemption Advanced American Tax

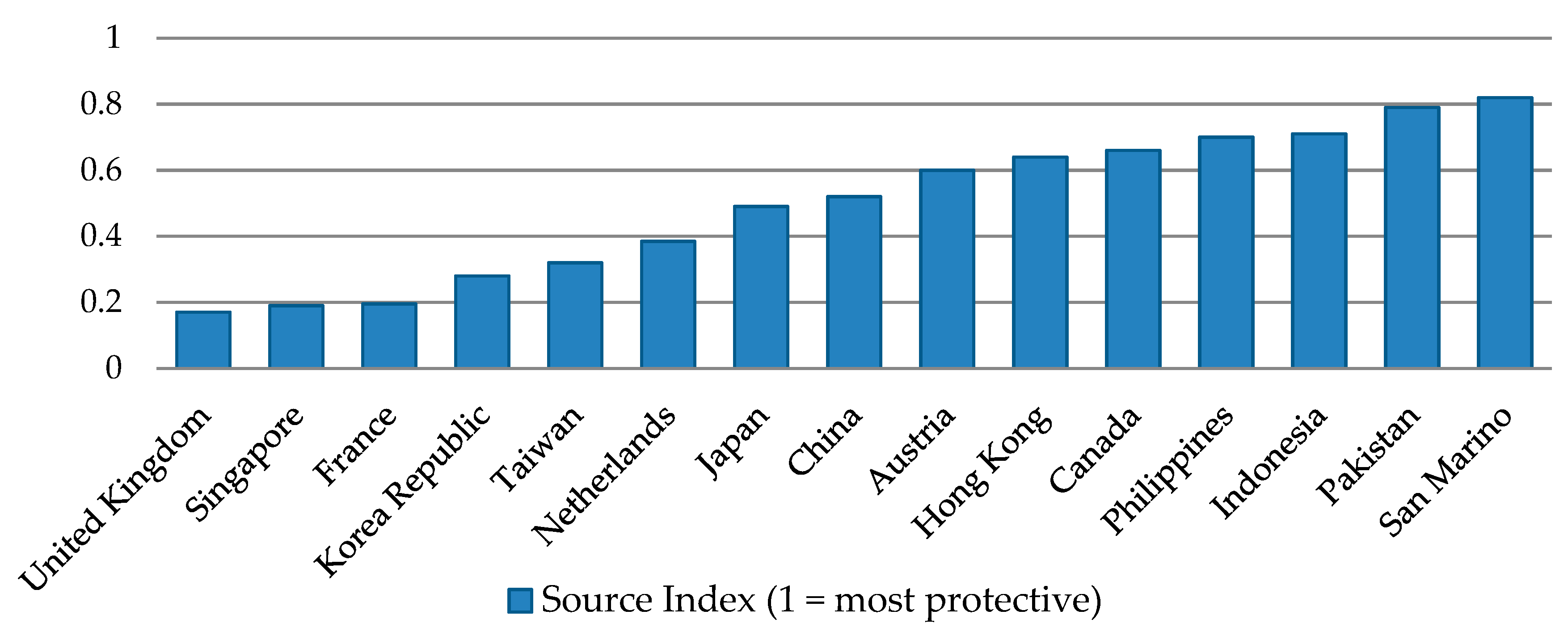

Jrfm Free Full Text Double Taxation Treaties As A Catalyst For Trade Developments A Comparative Study Of Vietnam S Relations With Asean And Eu Member States Html

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog